Vancouver, B.C., December 21, 2019 – Ximen Mining Corp. (TSX.v: XIM) (FRA: 1XMA) (OTCQB: XXMMF) (the “Company” or “Ximen”) is pleased to announce that it has closed its non-brokered private placement previously announced on December 11, 2019. The placement consisted of 897,437 flow through shares at a price of $0.39 per share for gross proceeds of $350,000. Each Flow-Through share consists of one common share that qualifies as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act.

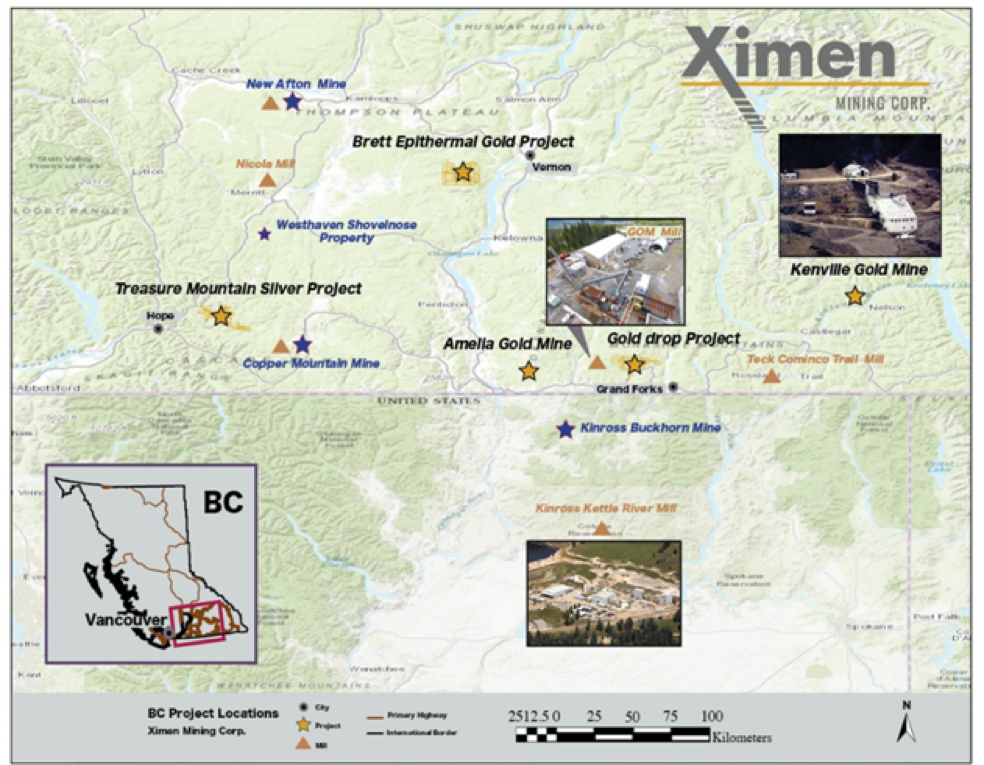

The net proceeds from the Offering will be used by the Company for exploration expenses on the Company’s British Columbia mineral properties. The Company paid a cash commission of $17,500 and issued 44,872 finders warrants to Qwest Investment Fund Management Ltd. The finder warrants are valid for 2 years from closing with an exercise price of $0.39. All securities issued in connection with the flow through Offering will be subject to a hold period expiring April 13, 2020.

The Company also announces it has closed a further tranche of a non-brokered private placement by issuing 250,000 units for gross proceeds of $75,000. Each Unit consists of one common share at a price of $0.30 and one transferable common share purchase warrant. Each whole warrant will entitle the holder to purchase, for a period of 18 months from the date of issue, one additional common share of the Issuer at an exercise price of Cdn$0.45 per share. The Company announces April 18, 2020 as the hold expiry date for this tranche of the private placement. The net proceeds from the private placement will be used for the further exploration on the Company’s British Columbia mineral properties and general working capital.

The Company also announces that it has arranged a non-brokered private placement of 132,564 flow through shares at a price of $0.39 cents per share for gross proceeds of $51,700. Each Flow-Through share consists of one common share that qualifies as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act. The net proceeds from the Offering will be used by the Company for exploration expenses on the Company’s British Columbia mineral properties.

A finder’s fee may be paid to eligible finders in accordance to the TSX Venture Exchange policies. All securities issued pursuant to the offering will be subject to a hold period of four months and one day from the date of closing. The offering and payment of finders’ fees are both subject to approval by the TSX-V.

Investor Relations: Sophy Cesar, 604-488-3900, ir@XimenMiningCorp.com

On behalf of the Board of Directors,

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations: 604-488-3900, ir@XimenMiningCorp.com