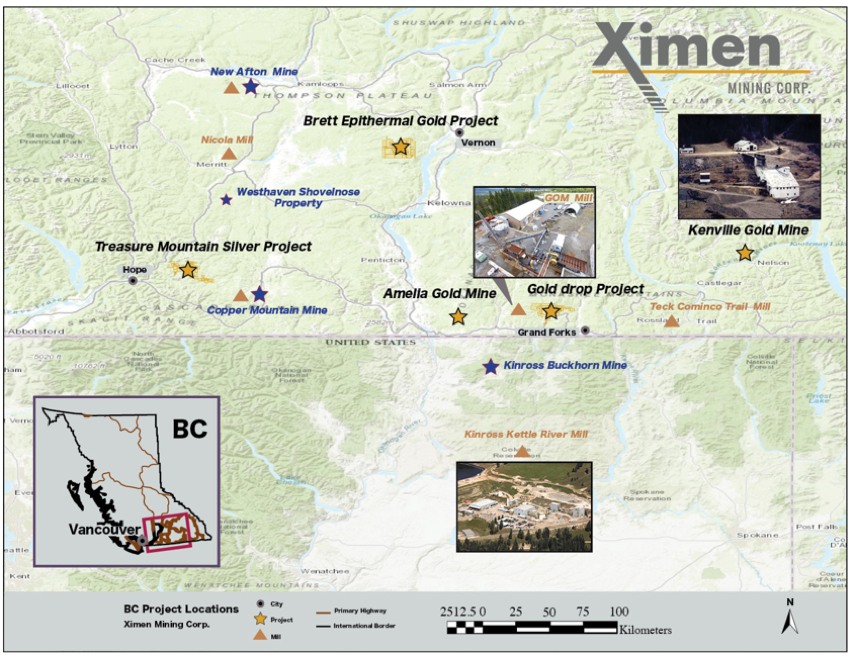

Vancouver, B.C. – June 20, 2019 – Ximen Mining Corp. (TSX.V: XIM) (FRA: 1XMA) (OTCQB:XXMMF) (the “Company” or “Ximen”) has entered into an agreement for a draw-down equity financing facility (the “Investment Agreement”) with Alumina Partners (Ontario) Ltd. (“Alumina”), an affiliate of New York-based private equity firm Alumina Partners, LLC. The Investment Agreement will provide the Company with up to C$8.0 million over a 24-month period to finance its exploration and on-going acquisition of gold assets in British Columbia.

Christopher Anderson, President and CEO of Ximen, stated, “This Agreement provides Ximen with additional capital to expand our exploration program on our Brett Epithermal Gold property near Vernon BC and allows us to accelerate our work programs planned for the Kenville Gold Mine near Nelson, BC.”

(Photo : Kenville Gold Mine Site )

“Alumina is excited to support Ximen as they move to systematically expand their precious metals holdings in the highly favorable mining jurisdiction of British Columbia,” said Adi Nahmani, Managing Member of Alumina. “As the gradual sector rotation back toward precious metals continues to gain traction, we anticipate the strong management team at Ximen being able to translate their substantial asset base into the real revenue streams of a production-stage company.”

(Photo : New Scoop Kenville Gold Mine )

The Investment Agreement is structured to provide Ximen with relatively quick access to private placement financing as and when required. Under the Investment Agreement, the Company has the right to draw down on the facility, at its sole discretion, through equity private placement tranches of up to C$500,000 each. Each tranche will be a placement of units (each a “Unit”), with each Unit comprising one Ximen common share (a “Share”) and one common share purchase warrant (a “Warrant”). The Units will be priced at a discount of 15% to 25% from the then most recent closing price of the Shares on the TSX Venture Exchange at the time of the applicable Company draw-down notice to Alumina. The Warrants will be issued at a 25% premium over the market price of the Shares and will have a term of three years. There are no standby charges or other upfront fees associated with the Investment Agreement. Each tranche of Units issued under the Investment Agreement will be subject to the acceptance of the TSX Venture Exchange, and the securities issued will be subject to the customary 4-month hold period.

On behalf of the Board of Directors,

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations: 604-488-3900, ir@XimenMiningCorp.com