Vancouver, B.C., January 30, 2020 – Ximen Mining Corp. (TSX.v: XIM) (FRA: 1XMA) (OTCQB: XXMMF) (the “Company” or “Ximen”) is pleased to announce that it is proceeding with a shares-for-debt filing to pay outstanding debts of $270,000.00. Approximately 771,428 shares in the capital stock of the Company will be issued to pay these outstanding payables. The shares-for-debt agreement is subject to TSX Venture Exchange acceptance and, if issued, will be subject to the customary four-month hold period.

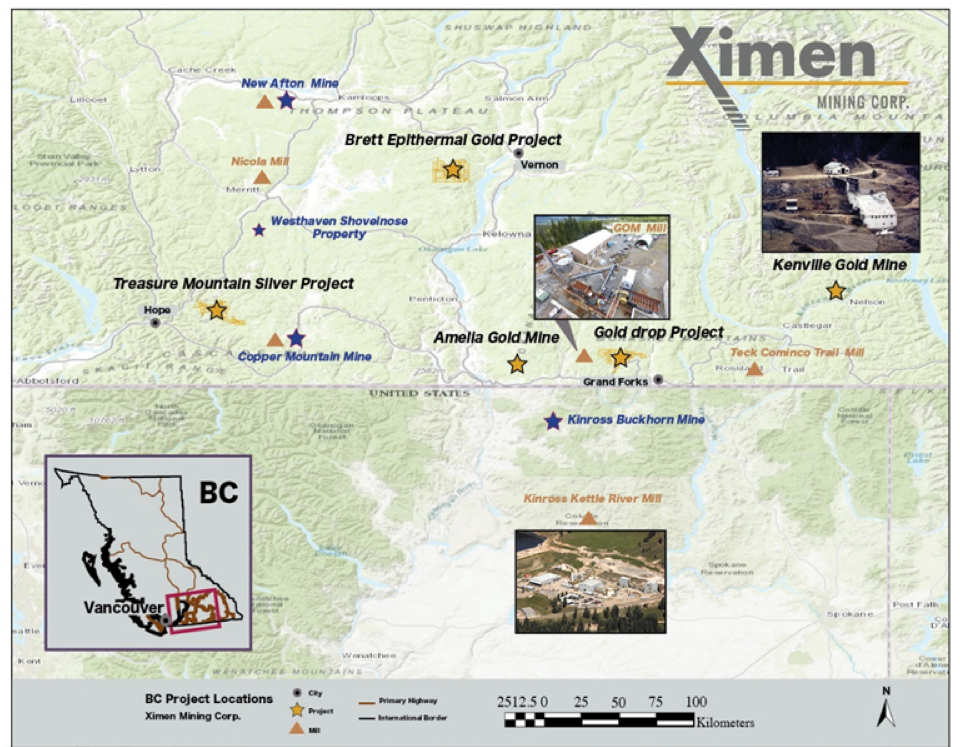

The Company also announces that it has closed a tranche of its drawdown equity financing facility with Alumina Partners (Ontario) Ltd., an affiliate of New York-based private equity firm Alumina Partners LLC. In this tranche closed on January 29, 2020, the Company drew down $150,000 from Alumina with Alumina receiving 500,000 units of Ximen consisting of a common share priced at 30 cents per share and an 18-month warrant exercisable at 45 cents per share. The hold expiry date for the placement is May 28, 2020. The net proceeds from the private placement will be used for the further exploration on the Company’s British Columbia mineral properties and general working capital.

The investment agreement will provide the Company with up to $8-million over a 24-month period to finance its exploration and continuing acquisition of gold assets in British Columbia.

The investment agreement is structured to provide Ximen with relatively quick access to private placement financing as and when required. Under the investment agreement, the company has the right to draw down on the facility, at its sole discretion, through equity private placement tranches of up to $500,000 each. Each tranche will be a placement of units, with each unit comprising one Ximen common share and one common share purchase warrant. The units will be priced at a discount of 15 per cent to 25 per cent from the then most recent closing price of the shares on the TSX Venture Exchange at the time of the applicable company drawdown notice to Alumina. The warrants will be issued at a 25-per-cent premium over the market price of the shares and will have a term of 18 months. There are no standby charges or other upfront fees associated with the investment agreement. Each tranche of units issued under the investment agreement will be subject to the acceptance of the TSX Venture Exchange and the securities issued will be subject to the customary four-month hold period.

Investor Relations: Sophy Cesar, 604-488-3900, ir@XimenMiningCorp.com

On behalf of the Board of Directors,

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations: 604-488-3900, ir@XimenMiningCorp.com