Vancouver, B.C., January 10, 2023 – Ximen Mining Corp. (TSX.v: XIM) (FRA: 1XMA) (OTCQB: XXMMF) (the “Company” or “Ximen”) announces that it is proceeding with its plan to do underground mine exploration development at its Brett Property, located near Vernon in southern British Columbia.

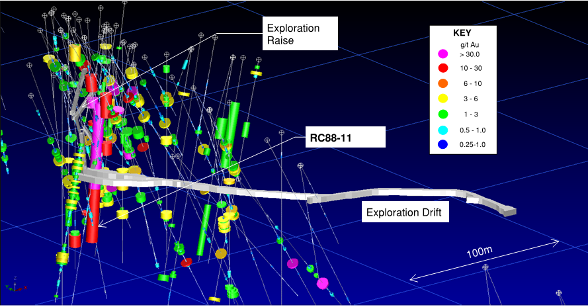

Perspective view of Brett conceptual mine model. New development (blue) will extend from old workings (orange). Also shown are diamond drill holes and assays greater than or equal to 3.0 grams per tonne gold.

The proposed development program includes:

- excavation of diamond drill stations in the existing drift,

- a 50 meter cross-cut from the exiting drift with a drill station,

- 200 meter drift parallel to the Main Zone, with stub drifts into the zone

- drill stations in the new drift, and

- a 50 metre cross-cut and diamond drill station from the new drift.

The new mine development will provide access for underground drilling and explore the Main Zone to the northwest. This development will follow the Main Zone and provide points from which to test parallel structures by underground diamond drilling. It is anticipated that this program will result in definition of mineralized zones for underground bulk sampling. A permit application for the work has been submitted and is now in the early stage of review. The Ministry has requested the Company to provide the following:

- Metal Leaching / Acid Rock Drainage Plan including results from initial sampling

- Water Management Plan

- Reclamation and Closure Plan

- Erosion and Sediment Control Plan

- Invasive Plant Management Plan

- Bat Management Plan

- Wildlife Management Plan

- Geotechnical

– Mine design by Professional Engineer, including a refuge station

– Ground Control Management Plan by Professional Engineer

– Clarification and details of rehabilitation of underground workings

– Plans and sections, along with a cost estimate, for the proposed final portal closure

– Mine Waste Dump design and management plan

The Company has committed to provide the requested plans and information.

The Brett epithermal gold property is located west of Vernon, in southern B.C. Surface exploration at the project has been delayed over recent years first due to the pandemic and then due to access issues resulting from wildfire and flooding events. Airborne magnetic and LIDAR surveys were the only activities conducted recently.

The current geological model is a low-sulphidation epithermal gold-silver deposit with vein-hosted and disseminated mineralization associated with faults and Tertiary dikes that intersect volcanic tuff layers.

Ximen believes the Brett property has very high potential for discovery of an economic gold deposit due to the fact that high-grade vein-hosted and low-grade bulk-mineable disseminated styles of epithermal gold mineralization have been identified in multiple zones.

Since its discovery in 1983, a total of 160 surface diamond drill holes (20,945 meters) and several reverse circulation holes have been completed on the property. Most of the drilling targeted the Main Zone, where high-grade gold is hosted in quartz-carbonate veins associated with a northwest-trending fault zone in argillic and silica-altered volcanic rocks of the Eocene Penticton Group. The Main Zone is a northwest trending fault that disrupted previously mineralized veins and host rocks. The veins contain visible gold and show textures characteristic of an epithermal deposit, including bladed calcite (see photos).

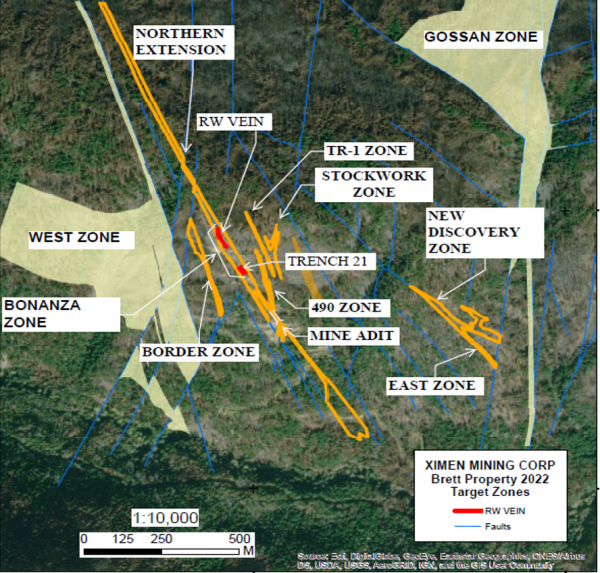

To date, surface exploration has delineated multiple mineralized zones. Along the Main Zone, the TR-21, Bonanza Zone, RW vein, North Extension Zone were identified. The Tuff Zone also lies along the Main Zone at depth below the TR-21 and Bonanza zones. Parallel zones were also discovered, including the TR-1, Stockwork, 490 and Border zones. East of the Main Zone the New Discovery and East Zones were discovered. Bordering all these are the Gossan and West Zones, which are large areas of altered rocks with gold geochemical anomalies.

The Bonanza Zone was the focus of previous work. Significant mineralization in the Bonanza Zone is substantiated by several diamond drill holes, including hole 87-29, which intersected 25.24 grams per tonne gold over a length of 8.62 meters (historic data).

Reverse circulation hole R88-11 intersected 69.52 g/tonne gold (2 ounce per ton) over 71.6 metres (historic data) in the Bonanza Zone. This result prompted underground development to test the possibility of developing a high-grade gold mine. In 1994-5, an underground adit was driven 250 m to access the Bonanza Zone. A raise was driven up from the drift to intersect the RC88-l1 within the shear zone. A sub-drift was driven about 15 meters above the level of the main drift, and the raise was continued another eight meters following the RC hole. This work failed to outline high-grade mineralization and it was concluded that the large intercept in hole RC88-11 was due to down-hole contamination. Further underground exploration done in 1995-96 included a 54-meter by-pass drift driven around a section of the old drift, and a connection to one of two raises driven earlier.

Also in 1996, a surface bulk sample was collected from the RW and TR-21 zones, located just north and south of the Bonanza Zone. A total of 291 tonnes at an average grade of 27.74 grams per tonne gold and 63.7 grams per tonne silver was smelted in Trail (Brett 2017 NI 43-101 report).

Metallurgical test work indicates the mineralization is amenable to gravity-flotation recovery. In 1995, a 4 kg sample with a head grade of 20.3 grams per tonne gold and 50.3 grams per tonne silver was tested (BC Assessment Report 25351). Gravity concentration recovered significant amounts of the gold and silver; the gold recoveries ranged from 55.1 % to 60.36 % and the silver recoveries from 20.3 % to 20.9 %. Flotation of the gravity concentration tails improved the overall gold and silver recoveries to 91.3% and 72.8%, respectively.

Screen capture of Brett 3D mine model showing drill intercepts and historic workings. Note location of historic hole RC88-11

Since acquiring the property, Ximen has conducted two surface drilling programs. The 2014 program discovered two new gold-bearing zones, with results including 34.18 g/t Au over 0.9 m from one zone and 16.7 g/t Au over 1.5 m from the second. Significant intervals of bulk tonnage gold mineralization were also intercepted, including 1.77 g/t Au over 31m, 1.88 g/t Au over 16.55m and 0.82 g/t Au over 33m. Significant intercepts from 2016 were 18.95 g/t Au over 1m, 3.13 g/t Au over 1.1 m, 13.35 g/t Au over 0.58 m and 5.7 g/t Au over 0.5 m in holes 1, 2, 11 and 17.

Samples collected by Ximen in 2014 were analyzed by Activation Laboratories Ltd. (Actlabs) in Kamloops, B.C. Actlabs is an ISO 17025 accredited laboratory. Samples were analysed for gold by Fire Assay with AA finish on a 30 gram sample. Samples that returned greater than 2 ppm Au by FA/AA were subsequently tested by metallic gold assay on a 500 gram sample of pulverized material.Other elements were determined by a multi-element suite using ICP-MS, and for mercury by cold vapour-FIMS.

Samples collected by Ximen in 2016 were submitted to ALS Canada Ltd. and analyzed for gold, silver, and a 32-element package by ICP analysis. This ALS facility is certified to standards within ISO 9001:2008 and has received accreditation to ISO/IEC 17025:2005. Analyses for gold were by Fire Assay and Inductively Coupled Plasma – Atomic Emission Spectrometry (ICP-AES). Silver and other elements were analyzed in a multi-element package using four-acid digestion and determination using ICPAES. Selected samples were also analyzed for gold by Fire Assay – Atomic Absorption Spectroscopy (AAS). High grade gold samples were analyzed for gold by Fire Assay and Gravimetric Finish and re-analyzed for silver by four-acid and ICP-AES.

The Company has granted 5,000,000 stock options at an exercise price of $0.15 to its directors, officers, employees and consultants. The options are exercisable for five years and will be cancelled 30 days after cessation of acting as director, officer, employee or consultant of the Company. The stock options are not transferable and will be subject to a four-month hold period from the date of grant and any applicable regulatory acceptance.

Readers are cautioned that historical records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations: 604-488-3900, ir@XimenMiningCorp.com